Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ethn

chief data plumber @alliumlabs | piping and scrubbing Blockchain Data for Apps, Analytics & Accounting | prev dir. eng ml @primer_ai, ai @stanford

Great analysis by @joel_john95, thank you for the feedback, must read!

Decentralised.Co5.8. klo 01.05

Our friends at @AlliumLabs just shipped their Hyperliquid dashboard. We played a small role in giving feedback and helping iterate how the product evolved.

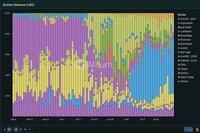

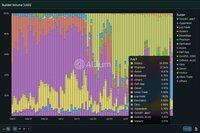

Builder codes are referral code mechanisms that pass on revenue to a developer for orders that settle on Hyperliquid. We have been studying the numbers to get an estimate of the size of the market and what happens when perpetuals products can be embedded anywhere.

Here are four key numbers that caught our attention:

1. Phantom accounts for ~49% of builder revenue

They say distribution is a moat, and few places make it as evident as Phantom's dominance of revenue generated on the exchange. With ~23k users interacting with Hyperliquid on any given day, Phantom accounts for close to half of all builder code revenue on most days.

They add ~500 new users each day, but these order sizes seem to be largely from retail users who trade with relatively high frequency.

2. Power Users Drive Volume

Compared to Phantom's ~3.4k active users (today), Insilico Terminal had ~150 users and BasedApp had 240 users. But each of those products had outsized impact on volume. Based currently accounts for 6% of volume, and Insilico does close to 35% on any given day.

The terminology for a "user" here may be flawed, as we don't entirely know how Insilico routes orders, but it helps to discern where the bulk of the volume originates from. While distribution helps rake in users, much of the volume today is with products that have power users.

(We are huge fans of the Terminal - and highly recommend using it)

3. Wallet Front-ends as Distribution

There has always been a hypothetical argument that wallet front ends are a great place for distribution, but one never had the numbers to aid that claim—until now. Allium's dashboards clarify that, on any given day, Hyperliquid sees close to ~400+ new users coming in from Phantom.

We speculate that, in the future, Phantom could negotiate for better fee or zero-fee models from products they integrate, as they have moats that emanate from the size of their distribution. It'd be interesting to see how this converts in consumer-adjacent segments like music, content, or gaming in the future.

4. Builder Codes Account for ~20% of Users

Imagine you had a primitive that bought in ~20% of your userbase. And it also gave ~25 billion in volume to your product. That's builder codes in a nutshell.

Builder codes are responsible for ~56k users on Hyperliquid across the 86 active products that have integrated them. For products - these codes are a new source of revenue. The estimated revenue per user on a product integrating builder code is $63. In other words, it allows people to focus on the distribution and have an easy avenue to monetise them.

If you head over to Allium's dashboard (linked below) - you can see a realtime stream of their markets and these figures updating in real time. It is the closest we have to one of the most transparent, open-markets that exist in the world today. It appears we've come a long way from the days of FTX.

Hyperliquid.

860

someone from abu dhabi is abusing our light bulb💡

how many times does it take a HL user to fix a light?

100000 times.

ethn4.8. klo 22.47

Bonus 🔆: Give the lamp in the corner a tug if you're a light mode maxi.

2,88K

ethn kirjasi uudelleen

One of the most underappreciated aspects of crypto is that you get real-time institutional-grade data, all for free.

On Wall Street, moats are made out of paywalls and delay. To track TradFi flow, you need:

– Bloomberg Terminal ($30K/year)

– CapIQ, FactSet, Pitchbook ($10K–25K/year each)

– A patchwork of gated data vendors

– Filings with 30–90 day lag

– Hidden dark pool and PFOF routing

To track crypto flow, you just need a browser:

– Live liquidation heatmaps

– Real-time whale trades and position sizes

– Wallet-to-wallet flows, token by token

– Onchain leaderboards and full account PnL

37,29K

I always recommend everyone to read this tome of wisdom - the lean startup, first world country building edition

Giuliano2.8. klo 23.19

Lee Kuan Yew is the most exceptional leader I've read about.

Long thread with how LKY took Singapore from third world to first:

2,02K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin