Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

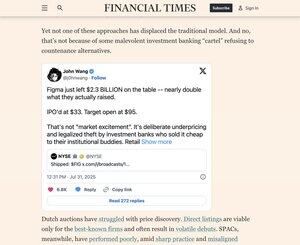

If a CFO lit $2B on fire, they’d be fired. But when bankers do it, it’s called a “successful IPO.”

@FinancialTimes calls it a win because their job isn’t reporting. It’s laundering Wall Street’s narrative.

Rent extraction wrapped in buzzwords. Delivered by the psyop machine.

@FinancialTimes @bgurley @figma @NYSE @litcapital link to the article and my thread below:

1.8. klo 00.31

Figma just left $2.3 BILLION on the table -- nearly double what they actually raised.

IPO'd at $33. Target open at $95.

That's not "market excitement". It's deliberate underpricing and legalized theft by investment banks who sold it cheap to their institutional buddies. Retail shoves in at open and gets used as exit liquidity.

Same playbook:

- DoorDash: $3.4B stolen

- Airbnb: $3.5B stolen

- 2021 total: $50B stolen

Since 2020, this cartel has stolen over $100 billion that should have gone to real value creators: founders, employees, and retail.

12,5K

Johtavat

Rankkaus

Suosikit