Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Everyone is talking about “APY farms” and “it's time to stabilize.”

But how do you choose a place and a token?

Here are my long-term choices🧵

1) @uselulo

🔮 What is this Lulo?

• Lulo is a savings platform for stablecoins, also known as digital dollars. Lulo offers a secure and efficient way to earn yield in DeFi.

• Lulo automatically allocates your deposits across four integrated DApps Kamino, Drift, MarginFi, and Save distributing funds based on current yields and market conditions to maximize your returns while maintaining your desired risk exposure.

🔮 Why should you choose Lulo?

• One of the main advantages is that they have an iPhone app, which greatly improves the usability of their product and makes it convenient to view your income and portfolio in real time.

• They have several modes: the minimum and safest one gives you 4.52% APY, and the maximum, also called the classic, gives you 7.42% APY.

• Another advantage is that Lulo automatically distributes your funds between protocols to achieve the highest APY this is basically the main reason why people choose them.

2) @hylo_so

🔮 What is this Hylo?

• Hylo is a suite of Decentralized Finance (DeFi) products on the Solana blockchain, engineered for scalability and independence from traditional financial infrastructure.

• In a nutshell, Hylo introduces an innovative decentralized stablecoin system consisting of two symbiotic tokens:

hyUSD & xSOL

🔮 Why should you choose Hylo?

• First of all, this is quite an early project, and participating from the early stage is already a good sign, as in the future there may possibly be an airdrop.

• They also recently closed a funding round, raising $1.5M from top funds.

• In addition to xSOL, which allows you to hold $SOL with 2x leverage without the possibility of liquidation, you can also use sHYUSD, which has been maintaining an APY of 18-20% for almost a month twice as much as on other platforms.

• They also have an XP system, which is a sign of future rewards.

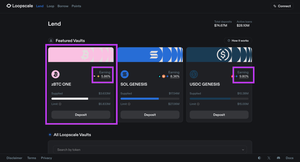

3) @LoopscaleLabs

🔮 What is this Loopscale?

• Loopscale is an innovative decentralized finance (DeFi) lending protocol built on the Solana blockchain.

• Unlike traditional pool-based lending models, Loopscale utilizes an order book-based architecture, allowing for more efficient and flexible lending and borrowing experiences.

🔮 Why should you choose Loopscale?

• One of the advantages is the variety of tokens, and specifically on Solana you can buy Bitcoin (zBTC) and even earn APY on it without needing bridges, etc.

• The average APY for stablecoins is around 10%, but for zBTC it is 5.86%.

• Another big advantage is the points system, and there are rumors that an airdrop is coming soon, which is only good for us.

🔮 Summary:

• Lulo → 4.52% - 7.42% APY (depending on the strategy)

• Hylo → 18-20% APY

• Loopscale → Depending on the strategy and pair you choose, usually 8-10% APY

13,58K

Johtavat

Rankkaus

Suosikit