Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

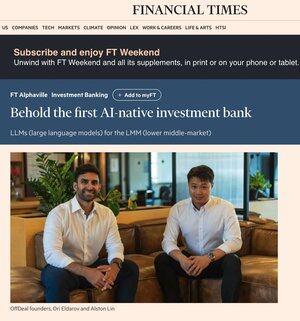

Ori Eldarov

CEO @ OffDeal - building the world's first AI-native investment bank

This thinking is why @harvey__ai approach was so contrarian at the time, and now they're at $100M+ ARR.

Two thoughts:

- law firms can sell more work now (total rev higher)

- AI cuts non-billables -> more time for more billables

Jordi Hays5.8. klo 02.03

Talking with a guy in big law: "Adopting too much AI will hurt our bottom line."

3,41K

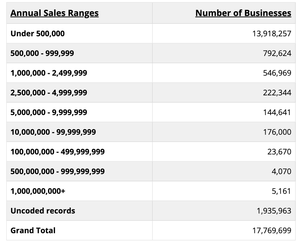

I don't think people realize just how many small businesses there are in america - just $10-100M in revs is 175k+, of which 5-10% change hands each year.

yes there are a lot of "brokers" / LMM banks - but they make up <20% of all closed deals in the space.

The rest are largely done DIY by business owners today (which has been very profitable for private equity)

Boring_Business4.8. klo 22.11

Very interesting discussion here around the future of investment banking and AI

Some thoughts

> Grok estimates that roughly 18,000 businesses in the U.S. generate $1-10M in profit

> Businesses of this size are typically valued at 3-5x EBITDA, on average, based on transaction data available

> With 18,000 businesses (midpoint) and using the average EBITDA multiple + transaction fee of 5% on the TEV, total whitespace market here is nearly $19B, conservatively

> As Offdeal ramps up, they will certainly start competing for larger deals but absolutely insane to me that a $19B market today has been left alone by existing banks. Essentially a land grab today

> It totally makes sense that a lot of investment banks won’t have integrated AI solutions. They will likely shop around for point solution vendors across the AI spectrum, and end up with a cluster of different tools

> Today, CRM at most banks don’t properly connect to the VDR. The excel models don’t connect up to a database of transactions. Transcripts from calls don’t integrate with DD trackers sent to buyers. I don’t see why traditional banks would get any better at this when AI comes into play

> For most investment banks, tech is essentially an after thought. The MDs (who make the decisions) are not the ones who use the technology (analysts and associates do). There is a massive mismatch between end user and decision maker. OffDeal is solving this problem directly by building a tech focused bank from ground up

Exciting times to live in

33,39K

Had so much fun sharing more about the future of investment banking with @andrewrsorkin @BeckyQuick and @JoeSquawk.

It's time to end the junior banker powerpoint grind and put them in front of clients.

Squawk Box4.8. klo 19.59

AI-native investment bank @tryoffdeal CEO @leveredvlad explains how the company helps small businesses sell themselves with the technology:

165

The future of finance will look very different in the coming years.

We’re building for that future.

Thanks for having me on, @APompliano!

Anthony Pompliano 🌪1.8. klo 02.40

The world's first AI investment bank is looking to conquer Wall Street.

I sat down with @leveredvlad to understand what they are doing, how their technology works, and why this is a better model.

41,19K

many such cases.

people love to hate on IB, but the level of attention to detail, work throughput and speed that gets drilled into you in your early years is unmatched.

sarah guo // conviction31.7.2025

tech people despise ibankers until the day they realize they really need someone smart, commercial, capable with people + numbers, who can take a lot of pain to get the job done, and then they desperately try to hire them (or ones that have been techwashed by a year in “bizops”)

6,6K

Yesterday's @FinancialTimes article went super viral and we got flooded with questions about the $2M banker bonus. The math is pretty simple actually:

> $5M EBITDA business sells for 6x

> $30M EV -> $1.5M fee

> $1.5M fee -> $300K bonus to banker

And that's just one deal.

If you're a banker interested in running your own deals and using the most cutting edge AI, we'd love to hear from you. We're drowning in deal flow and need help.

Apply on our website.

67,85K

Agree with Pomp here.

Importantly - we're not trying to compete with GS or Evercore - AI allows us to serve customers in the $1-10M EBITDA range but with the same quality of service that you might get at a larger Wall Street firm.

AI is an enabler to do more work for the client, move faster, and ultimately deliver a better customer experience - all at extremely attractive unit economics.

Anthony Pompliano 🌪31.7.2025

The first AI investment bank is looking to disrupt the incumbent firms.

Entire businesses are going to lose to people who can harness this new technology.

7,85K

Thanks for having me on! will have to run it back soon @jordihays @johncoogan

TBPN30.7.2025

IN NEWS: @tryoffdeal has raised a $12M Series A.

We brought CEO Ori Eldarov (@leveredvlad) on the show to talk about founding the first AI-native investment bank.

"I'd be lying if I said we didn't consider building software for banks."

"But we saw how bureaucratic large banks and how long it takes to inact any meaningful change. Call transcription was the number 1 requested feature (even though Zoom exists)."

"I kept thinking, if I was running my own bank, I would do it completely differently."

"We decided to go all in on building our own investment bank from scratch."

13,17K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin