Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Mars_DeFi

Agentic DeFi is coming to you this week.

Infinit's v2 will be announced this week.

Kaito snapshot soon and very likely, $IN TGE this week.

Who says no ?

INFINIT4.8. klo 20.00

Strategy Creators monetize.

Users execute.

Agents coordinate.

The Agentic DeFi Economy unifies under $IN.

To INFINIT and beyond. This week.

1,6K

As a space, we talk a lot about product but rarely enough about how token design reflects long-term conviction.

In most cases, the tokenomics is the real pitch deck.

And $IN isn’t just a token.

It’s the core economic layer of @Infinit_Labs . With $IN :

● Stakers win.

The protocol rewards $IN stakers with:

• A share of all DeFi strategy execution fees

• Access to premium agent features

• Early unlocks on AI tools and top-tier strategies

• Higher usage limits

• Governance rights over how the protocol evolves

● But it doesn’t stop there.

INFINIT is introducing attention-based tokenomics:

The more a strategy or agent is used, the more $IN it earns.

KOLs/Anyone create strategies.

Users execute in one click.

AI does the heavy lifting.

$IN binds it all together.

This aligns values with actual usage rewarding contributors, not speculators.

___________

Now let’s talk about the tokenomics.

Here’s what stood out:

● 49.5% goes to the community & ecosystem.

Not for farming hype, but for creators, infra, audits, growth, and long-term operations.

This isn’t a team-first token. It’s ecosystem-first.

● The vesting? It’s built to last.

• Core contributors (20%) - 4-year vest

• Investors (25.5%) - 1.5-year vest

• Community & Ecosystem (49.5%) - 4-year vest

• Airdrop (5%) - for early contributors

The timeline CLEARLY matches the mission.

Compare this to the usual big VC allocations, fast unlocks, and airdrops with zero retention because there's no utility.

$IN is different. It’s designed to scale with the product.

As usage grows, so does token utility, rewards, and governance power.

Still not bullish anon ?

6,07K

Imagine being able to tokenise real-world assets like bonds and shares under your brand – fully compliant, live within days.

As straightforward as setting up an e-commerce platform. That’s what @tokenforge offers: enterprise-grade tokenisation infrastructure, engineered for seamless integration into existing systems.

Tokenforge’s TokenSuite includes all critical components for compliant asset issuance – from built-in security checks and safe custody to registrar services and liability umbrella coverage.

Everything is API-first, modular, and ready to plug in.

This is not just another crypto pitch – it’s real infrastructure powering RWA tokenisation across Europe.

✅ Live in 5 EU countries

✅ 30+ platforms launched

✅ Built-in fee utility for issuers

✅ Compliant from day one

$TKFG is the utility token embedded in this infrastructure.

The referral-only presale is running on Tokenforge’s own PresalePad, built in-house and MiCAR-aligned.

No KYC required to register – just email and wallet.

Access here:

Use code [ KLCAD3H9 ] to join.

6,48K

Back in the early 2000s, owning a piece of internet infrastructure seemed like a big ask.

Today, you have that same opportunity—with XR.

But this time, it’s not routers or data centres…

It’s Guardian Nodes by @mawariXR.

Think of Guardian Nodes as the OG Bitcoin miners—but for the Spatial computing.

Each node powers immersive content delivery—AR/VR and more—across Mawari’s growing XR ecosystem while verifying streaming quality.

These guardian nodes ensure accountability across the Mawari network with over 140,000 Guardian Node licenses committed to the network.

Do you also know that as a node operator you can earn up to 20% of total value flows?

That means that with guardian nodes, you have :

→ Composable rewards

→ Cross-project exposure

→ Real, modular yield

Guardian Nodes are NFTs for XR infra that are not subject to hype cycles

Just like how MP3 unlocked the digital music era, Mawari is unlocking global XR streaming.

And Guardian Nodes? They’re the bandwidth.

__________

But what makes this even more powerful?

Mawari is backed by 7+ years of R&D, with real enterprise momentum—not whitepapers.

• Each node scales as the ecosystem grows.

→ More aapps = more usage

→ More usage = more upside

This automatically positions guardian nodes as the gateway into the fast-growing spatial computing sector.

3,58K

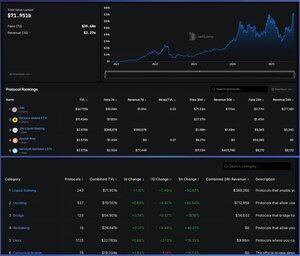

The recent rally in ETH price has reignited momentum across DeFi—especially in liquid staking.

Now liquid staking has overtaken lending to become the largest DeFi sector by category.

At the forefront of this shift is Lido, now leading the pack with $34.64b in TVL, which accounts for nearly 50% of the entire liquid staking market (currently at $71.95b).

But @LidoFinance isn’t just dominating in TVL.

It’s also the top protocol by fees and revenue among all LSTs, raking in $71.33m in fees and generating $7.13m in protocol revenue.

The DeFi narrative is coming back and liquid staking is one to keep an eye on.

2,57K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin