Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Samyak Jain 🦇🔊🌊

Co-founder @Instadapp @0xfluid @avowallet. DeFi. Forbes 30 under 30 India/Asia.

Samyak Jain 🦇🔊🌊 kirjasi uudelleen

Fluid DEX v1 proved that smart collateral + smart debt unlock unparalleled capital efficiency for non‑volatile pairs.

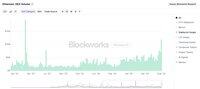

Yesterday, Fluid cleared 55% of all stablecoin volume across Ethereum, Arbitrum, Base, and Polygon.

I believe this success will extend to volatile pairs with FLUID DEX v2.

Currently DEX v1 does programmatic range management that works well for non volatile pairs, but DEX v2 will introduce the ability for LPs to tailor their liquidity exactly like in uniswap's granular tick based system.

Let me explain why ⬇️

Imagine you are a market maker in Uniswap's ETH-USDC pool today. Everything else equal do you prefer earning lending rates on top of whatever your current asset composition is? The obvious answer is yes. As a result, smart collateral on its own is always superior to simply LPing in Uniswap. Happy to hear contrarian views to this.

Now a market maker provides liquidity because they believe its a winning strategy, i.e they express a market view that fees will outweigh losses resulting from asset composition changes. Smart debt allows market makers to low‑cost leverage their strategies. It reduces their cost of capital. The degree of leverage and resulting liquidity will obviously be not used to the same degree as with pegged pairs because volatile pairs also make your LTV more volatile and hence high leverage leads can lead to liquidations. Still a healthy level of leverage with some looping allows market makers to scale their liquidity at minimal capital cost.

TLDR, the capital efficiency unlocked by smart collateral and smart debt put Fluid LPs at a competitive advantage and as a result LPs can profitably offer lower fees to trader

5,29K

So Aerodrome which counts "ALL THE FEES" generated by LPs as revenue and send that fees to buyback AERO tokens to give those AERO tokens back to LP holders. Creating a confusing ponzinomics with tokens and tells that they earn the most revenue in the DEX space.

Pretty stupid comparison imo.

The only DEX (outside of Fluid) that I have huge respect for is Uniswap because it's a pure LP play, no ponzi tokenomics to keep the liquidity hooked to protocol. Liquidity is there because it's earning real fees out of it.

34,15K

Fluid DEX Lite is here! 🌊🌊🌊

From ideation to launch in less than 20 days!

Over next few weeks as it gets widely integrated, it should drive $200M to 400M average daily volumes!

Fluid 🌊4.8. klo 23.25

Fluid DEX Lite is live 🌊

Kicking off with a USDC-USDT pool and more pools over the next few weeks.

Integrated with @KyberNetwork and @VeloraDEX, and other DEX aggregators to follow soon.

Once fully integrated, we expect an extra $200M–$400M daily volume.

Integration docs:

9,1K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin