Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Ignas | DeFi

What's the current dominant crypto narrative?

Memecoins? Nope but some like $PENGU and SPX6900 do great

DeFi? Some like $SPK pumped but others struggling

DATs? Helped pump $ETH and $ENA managed to time it well

Yet it feels like the days when a single narrative could lift all tokens have ended.

Instead, outliers driven by a specific set of catalysts perform well.

Catalysts that rely on the hard work of teams and their communities.

37,42K

We reached an L2 saturation point:

Aave deployed on 16 chains, but the new deployments are operating at a loss (Soneium, Celo, Linea, zkSync, Scroll).

As a result, Aave is unlikely to deploy on Bob BTC L2, even though it passed the temp check vote.

Now, a proposal on the Curve forum suggests cutting all future or ongoing L2s.

Reason? They generate barely $1.5k USD in fees while costing the team financial and time resources.

Real tough time for undifferentiated L2s.

98,2K

Bullish news -> No pump? Buy & wait

Bearish news -> No dump? Panic before others.

When early on Trump was spreading FUD with tariffs, the macro uncertainty didn't initially impact the market. But then the market dumped. HARD.

I remember this clearly because @alpha_pls told me to sell, as he had learnt his lesson not to ignore macro during last cycle.

Similarly, when ETF applications started and ETFs launched, it took time for price to pump. When it did, pumps were glorious.

Same now.

Feeling bullish.

16,64K

"At a large enough scale, tokens would in effect turn private firms into public ones" - The Economist

Because of this (and other reasons) "the view that crypto has not produced any innovations of note can be consigned to the past"- The Economist concludes.

TLDR: We Won.

Joe Weisenthal1.8. klo 02.50

If tokenization of private stock (a la Robinhood's efforts) takes off, I wonder if we're even going to talk about public vs. private companies in the future. May just be kind of a spectrum of various levels of liquidity and disclosure.

10,63K

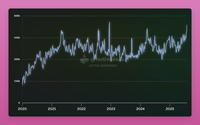

Bullish $ETH: L1 is scaling and users are coming back.

- Ethereum active addresses are nearing ATH, exceeding DeFi summer levels.

- ATH is also coming for transaction count

- Yet transaction fees are at all-time LOWS.

Even more bullish: EF plans to roll out zkEVMs to the Ethereum mainnet within a year, making it even cheaper and faster.

It's amazing to be once again excited for the Ethereum L1's future.

Not just because of the price, but also technical developments, and users using it.

Send $ETH to $10k with haste.

30,4K

$LINEA Airdrop post could've been 3 announcements:

Two great and one worrying:

- 20% of net income gas fees in ETH will be burned, while 80% will burn LINEA.

- 10% of initial airdrop. 85% to the community. Lovely.

The worrying part:

Bridged ETH will be natively staked and Linea LPs will gain this yield plus returns from DeFi activities, with "top risk-adjusted" returns.

Is it just native staking? Or will Linea use bridged ETH in their DeFi ecosystem like @katana ?

From the announcement, "top risk-adjusted" means some asset management.

But this capital rehypothecation caused massive FUD for Polygon when they proposed to use bridged funds in DeFi.

Would like to see more details on how bridged ETH will be used.

Seeing Eigen Labs among Consortium partners, seems that $ETH could be restaked.

31,78K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin